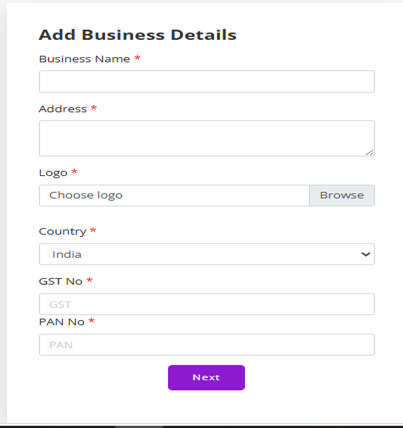

- After successfully logging in to your Invoice Blazer account, navigate to the dashboard, and then you need to fill in the details like Business Name, Address, Logo, Country, GST, and PAN Number.

1. Business Name

This is the official name of your company or organization.

- It should be the registered name you use for all legal, financial, and business activities.

- This name appears on invoices, bills, receipts, tax documents, and business communication.

2. Address

This is the complete physical address of your business.

- It includes building/door number, street name, area, city, state, and PIN code.

- The address is used for identification, postal communication, and legal verification.

- It also appears on official documents and invoices.

3. Logo

This is the visual symbol or design that represents your business.

- A logo helps customers recognize your brand easily.

- It can be an image, icon, or text design placed on invoices, websites, social media, and marketing materials.

4. Country

This indicates the country where your business is located or registered.

- Adding the country helps in international communication and ensures your business follows the correct tax rules, currency formats, and legal standards.

5. GST No (Goods and Services Tax Number)

This is a unique 15-digit tax identification number issued to businesses in India.

- It is required for companies that sell products or services and fall under the GST rules.

- It allows you to collect GST from customers and claim input tax credits.

- Every invoice for taxable goods/services must include the GST number.

6. PAN No (Permanent Account Number)

This is a 10-character alphanumeric code issued by the Income Tax Department of India.

- PAN is used for all tax-related activities, such as filing returns and verifying transactions.

- It also helps identify your business legally for financial records.

- PAN is often required on invoices, banking documents, and financial agreements.

- Once you have entered all the required and valid information correctly, the system will automatically redirect you to the next page.

- After completing this step, click on the “Go to Dashboard” button to proceed to your main account dashboard.

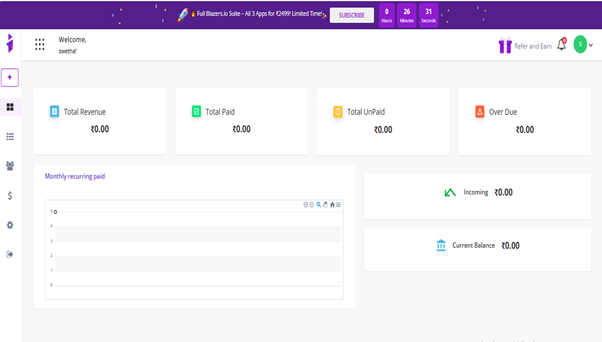

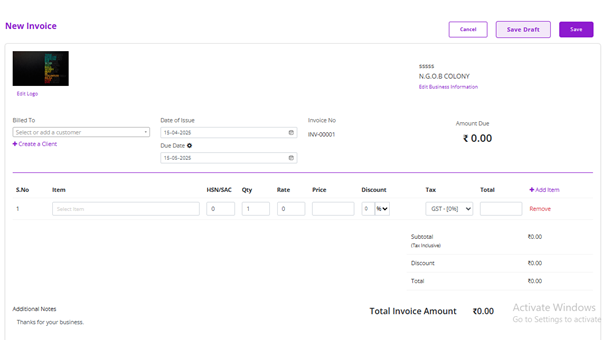

- Click the plus (+) symbol to create a new invoice and open the invoice creation page.

1. Billed To (Client Name)

This shows who the invoice is being sent to.

· It includes the client’s full legal name or company name.

· Helps identify which customer is responsible for making the payment.

2. Date of Issue

Also called Invoice Date.

· This is the exact date when the invoice is created and sent.

· It is important for accounting and tracking payment timelines.

· Payment terms (like 7 days or 30 days) are calculated starting from this date.

3. Due Date

The final date by which the client must make the payment.

· Automatically calculated based on your payment terms.

· Helps avoid delays and ensures timely payments.

· After this date, late fees or reminders may apply.

4. Invoice Number

A unique identification number is assigned to every invoice.

· Helps you track, organize, and reference invoices easily.

· Prevents duplication and is required for audits and accounting.

· Usually follows a serial pattern (e.g., INV-101, INV-102, etc.).

5. Item Details

This section describes what the client is being charged for.

· Can include product names, service descriptions, or project details.

· Helps the client understand exactly what they are paying for.

· Should be clear and easy to understand.

6. Quantity

The number of units or the amount of service provided.

· For products → Number of items.

· For services → Hours, sessions, or project units.

· Used to calculate the total cost.

7. Rate

The price per unit of the item or service.

· Multiply Quantity × Rate to get the item amount.

· Should be clearly stated to avoid confusion.

8. Discount (if applicable)

Any reduction in price offered to the client.

· Can be a fixed amount or a percentage.

· Discount is deducted from the item’s subtotal before tax calculation.

9. Tax

The applicable tax amount on each item or the entire invoice.

· In India, this usually includes GST (CGST + SGST or IGST).

· Calculated after applying any discounts.

· The tax rate varies depending on the product or service category.

10. Total Invoice Amount

This is the final amount the client needs to pay.

It includes:

· Subtotal (quantity × rate)

· Minus discounts

· Plus tax

- Enter the billing details by providing the necessary information. Then, create a new client by filling in all the required fields, and once completed, save the invoice.

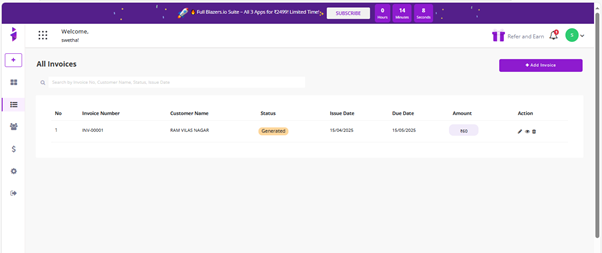

- The generated invoice, along with its current status, will be displayed below for your reference.